colorado electric vehicle tax credit form

The motor vehicle or truck must have a maximum speed of at least 55 miles per hour. Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle including an electric vehicle.

Electric Vehicle Incentives What You Need To Know

Specific Instructions Line 1 Enter the qualified electric vehicle passive.

. The motor vehicle or truck. Colorado electric vehicle tax credit form Colorado. Colorado Tax Credits.

You may use the Departments free e-file service Revenue Online to file your state income tax. The motor vehicle or truck must be titled and registered in Colorado. Plug-In Electric Vehicle PEV Tax Credit.

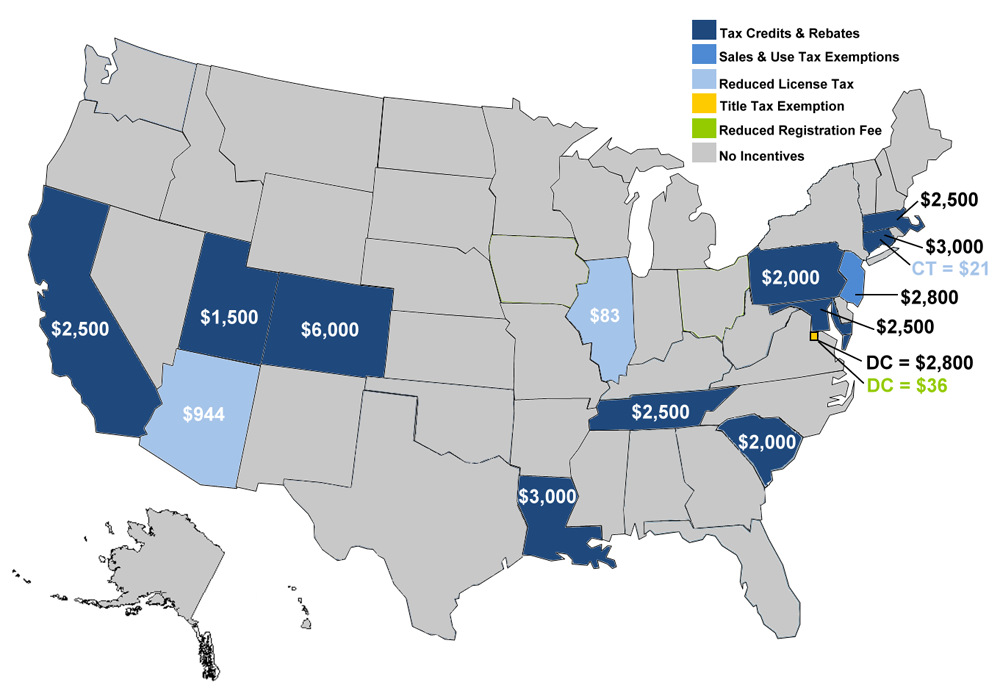

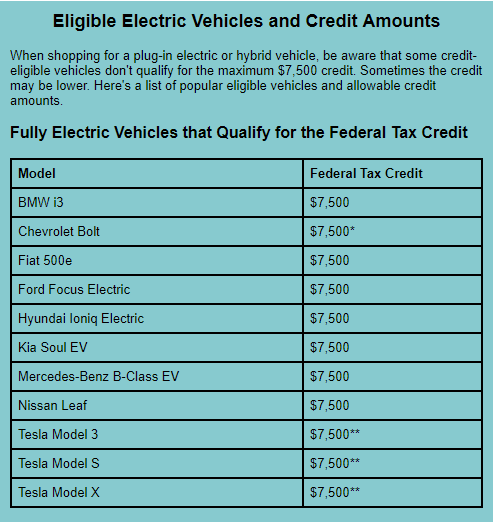

Colorado Tax Credits. Sales Tax Return for Unpaid Tax from the Sale of a Business. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in.

Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled. Does Colorado have an EV Tax Credit. 2500 credit received with state income tax refund for full battery electric vehicle BEV may be applied at purchase with many electric vehicle.

Extension of Time for Filing Individual Income Tax Payment Form. Maryland offers a tax credit up to 3000 for qualified. Colorado electric vehicle tax credit form Colorado.

Drive Electric Colorado exists to. You can get the credit by submitting the appropriate forms with your tax return. Use Form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year.

We have established a goal. Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in.

People are looking for information about a Colorado EV tax credit and incentives for electric vehicles in Colorado including incentives and rebates for home chargers. There is a state tax credit that you can take advantage of in Colorado. The motor vehicle or truck must have a maximum speed of at least 55 miles per hour.

About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit. Save time and file online. November 17 2020 by electricridecolorado.

Be In Charge. Illinois offers a 4000 electric vehicle rebate instead of a tax credit. Information on tax credits for all alternative fuel types.

Iowa EV tax rebate. Maine electric vehicle rebates. Answered on Jun 16 2022.

Colorado Tax Credits Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric. You do not need to login to Revenue Online to. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles.

Extension of Time for Filling C. Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado.

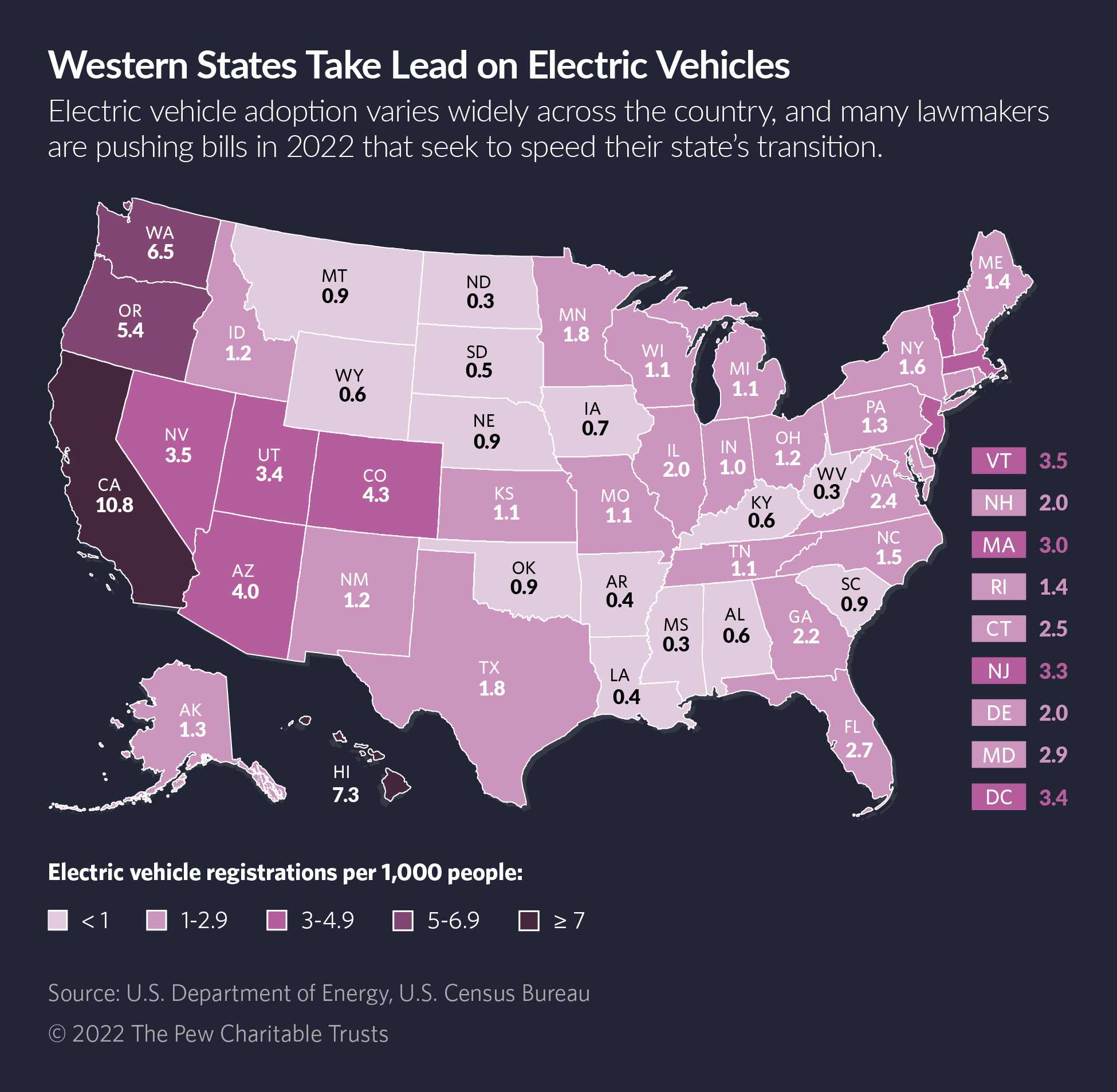

Electric Cars Will Challenge State Power Grids The Pew Charitable Trusts

The 2022 Kia Ev6 The Hottest New Electric Vehicle On The Market In Colorado Peak Kia North Blog

/driving-tesla-model-x-on-road-ELECTRICCARRT0521-466db75a3f5a4c99b58140d9ef0feca1.jpg)

The Ultimate Guide To Taking A Road Trip In An Electric Car

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

How To Get Money For Evs And Charging Chargepoint

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Gm Vehicles Eligible For Ev Tax Credit On January 1st 2023

Electric Vehicle Tax Credits And Rebates Electric Car Incentives

Fact 891 September 21 2015 Comparison Of State Incentives For Plug In Electric Vehicle Purchases Department Of Energy

:max_bytes(150000):strip_icc():gifv()/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller